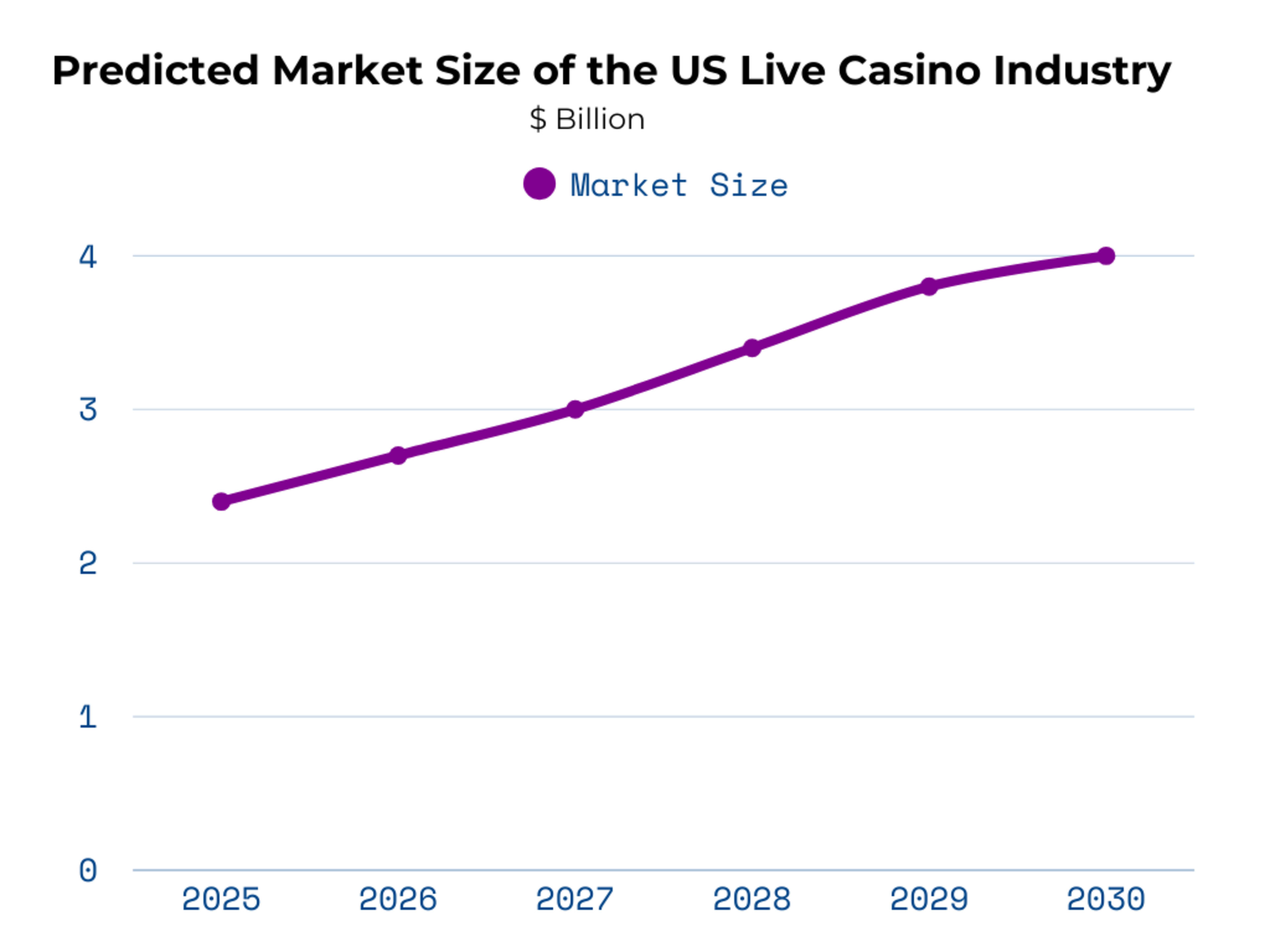

Thinking about playing at a South African online casino, where the clatter of chips and dealer banter is increasingly replaced by sleek digital screens and automated thrills? That's the reality as electronic table games (ETGs) surge ahead, with the US ETG market valued at $2.4 billion in 2024 and projected to hit $4.1 billion by 2033—a robust CAGR of about 6.1%. This overtake isn't just a tech fad; it's reshaping how casinos operate, players engage, and the industry evolves. In this blog, we'll dive into why ETGs are winning the battle against traditional live dealers, backed by fresh 2025 data, real examples, and expert insights. Whether you're a gaming enthusiast, industry pro, or investor, buckle up for the future of casino gaming.

Why ETGs Are Overtaking Live Dealers in South African Casinos

The shift from live dealt games to ETGs is accelerating, driven by efficiency, player demands, and economic pressures. Globally, the ETG market jumped from $1.97 billion in 2024 to a forecasted $3.42 billion by 2033, boasting an 8.2% CAGR, as casinos seek lower costs and higher throughput. But in South Africa, it's a full-on overtake—why?

The Post-Pandemic Push: Contactless and Cost-Effective

COVID-19 flipped the script on casino operations globally. Labor shortages and health concerns post-lockdown made contactless ETGs a no-brainer, minimising face-to-face interactions while meeting pent-up demand for popular casino games. While specific regulations vary heavily by province in SA, the general trend is towards greater efficiency. In 2025, this influence lingers: casinos report faster recovery with ETGs, which offer 24/7 play without staffing woes. Regulatory shifts, where applicable, can also favour these more streamlined operations.

Real-World Examples: Major South African Casinos Embracing ETGs

Across South Africa, from the glittering casinos of Johannesburg to operations in the Western Cape and beyond, 2024 and 2025 have marked a decisive turn toward electronic table games. The transformation is not subtle—it is a sweeping reinvention of the casino floor.

In Johannesburg, a major casino resort, let's call it 'Gold Reef City Deluxe' for illustration, is amid a significant transition aimed at enhancing operational efficiency and player capacity. Driven by the need to cater to a large and growing tourist and local player base, the casino has integrated ETGs at the heart of its gaming strategy. Blackjack and roulette terminals now populate key areas, allowing more players to participate simultaneously without the need for a large number of additional dealers. This move reduces operational strain and demonstrates how leading South African properties are innovating for a new generation.

Further afield, a popular casino in the Western Cape has reported strong revenue growth, a figure noticeably bolstered by its strategic investment in ETGs. Unlike traditional expansions that often require parallel staffing increases, these ETG installations allowed the casino to accommodate peak visitor numbers seamlessly. This proved to be more than just a temporary fix—it positioned the property as a forward-thinking model for regional casinos navigating operational challenges and fluctuating demand.

On the East Coast, the transformation continues with casinos in Kwa-Zulu Natal. Properties here are increasingly making ETGs, including electronic baccarat and other popular table games, central to their offering. This approach is designed to capture the interest of younger, tech-savvy visitors. It powerfully reflects lessons learned during recent years, when demand for contactless and self-directed play surged. By leaning heavily into ETGs, these casinos are positioning themselves not as traditional venues experimenting with digital formats, but as establishments built around them.

Cost Breakdown: ETGs vs. Live Dealers – The Numbers Don't Lie

Money talks in high roller live casinos, and ETGs scream savings. Traditional live dealers rack up high labor costs—think $150-$200 per hour in wages alone—while ETGs slash overheads by up to 50% through minimal staffing and faster game speeds. Here's a head-to-head comparison:

Player Preferences: Who Loves ETGs and Why?

The demographics around ETGs reveal a clear generational divide.

- Younger Players (18–34 years): This age group represents the overwhelming bulk of ETG adoption, accounting for over 95% of electronic gamers in 2025. For Gen Z and younger Millennials, ETGs align perfectly with their digital-native lifestyles. They value the privacy of terminals, the ability to learn without public embarrassment, and the low-stakes bets ($5–10) that make experimentation more affordable. These players are also accustomed to mobile gaming and online interfaces, so transitioning into ETGs feels natural.

- Millennials (30s–40s): While slightly older, Millennials dominate the online gambling sector and show a strong preference for ETG blackjack and baccarat, particularly for solo play sessions. Their busy lifestyles make quick, on-demand gaming appealing, and ETGs meet this need without the social expectations of live dealer tables.

- Older Players (45+ years): This group continues to gravitate toward live dealers. For them, the allure is not speed or efficiency but the social atmosphere—dealer banter, camaraderie with tablemates, and the traditional casino experience. However, some older players have begun exploring ETGs for their accessibility and reduced intimidation factor, particularly when learning new live casino games.

Culturally, ETGs are transforming the casino environment. The old image of rowdy, crowded tables is being replaced by tech-driven zones, sleek electronic setups, and quieter, more individualized play. This reflects a generational shift in entertainment, where personalization and technology are now central.

Operator Insights: What Casino Bosses Are Saying About ETG Strategy

Casino executives have become vocal advocates of ETGs, often highlighting two key drivers: financial resilience and audience expansion.

- Financial Growth: Multiple top-rated live casino platforms explain that they are leveraging ETGs to drive profitability during a time when labor costs are unpredictable and staffing is challenging. By reducing dealer reliance, casinos enjoy higher margins per table and greater throughput per hour.

- AI Integration: Another casino leader emphasizes that AI and machine learning are transforming ETG operations. AI is not only used for marketing and player retention but also for responsible gambling tools—detecting risky patterns and offering real-time interventions.

- Strategic Agility: With ETGs, casinos can reconfigure floors more quickly, adapt to peak visitor times, and attract tech-savvy younger crowds without alienating traditional players. This adaptability has become a cornerstone strategy in 2025’s volatile economy.

Cutting-Edge Innovations: ETGs Get Smarter in 2025

2025 brings ETG wow-factors like AI-personalized betting in blackjack and AR overlays for immersive roulette. Hybrid systems blend live wheels with digital interfaces, while VR dealers elevate baccarat. These tech leaps bridge the authenticity gap, making ETGs feel alive without the human element.

The Employment Equation: Jobs Gained, Lost, and Transformed

ETGs disrupt jobs—potentially cutting dealer roles by 20-30%—but the industry forecasts 17% overall growth through 2031, creating tech maintenance and analytics positions. In 2025, unions push for reskilling, turning potential losses into opportunities. Economically, it's a mixed bag: fewer low-skill jobs, more high-tech ones.

Global Perspective: US vs. Macau and Europe in the ETG Race

The US is catching up fast, but Macau leads with ETGs generating 37% more profit than traditional tables, post-2019 adoption. Europe's slower, favoring live dealers culturally, though the UK ramps up for compliance. US casinos blend both, using ETGs for efficiency while preserving social hubs— a balanced overtake.